The power of online engagement tools

As retirement strategies become more complex, and fears around retirement affordability increase, more and more Australians are turning to online superannuation engagement tools to help guide them in their decision-making.

In turn, these online tools are providing an excellent way for super funds to engage with, assist and retain their members.

Offering a glimpse into the future

As life-expectancy increases, and the cost of living rises, it’s no wonder many people are taking a keener interest in their super balances, now and the projected future.

They’re the smart ones: planning, or at least considering ways to ensure their super will be sufficient to meet their retirement dreams. Online engagement tools are a powerful way to estimate their desired annual income in retirement, or how much they’ll need in super to achieve this.

While they’re not crystal balls, and they don’t offer the same depth of insight as individual, yet expensive face-to-face financial planning, they do equip users with a potent and suitably individualised picture of their future selves in a way that’s accessible, secure, private, and free.

By creating a safe environment, users are encouraged to explore and test different combinations of numbers and influencing factors that different decision scenarios are likely to deliver in years to come. It provides an attractive platform that appeals to the basic human desire to ‘predict’ the future.

Motivations can be varied, but well-designed, user-friendly calculators offer the potential to:

- Reduce anxiety about retirement needs

- Improve confidence

- Encourage the user to seek out financial guidance and support.

Making difficult questions easy

Whether they are engaged with their super or not, most Australians are unsure about how much money they will need in retirement.

Even answering questions about what constitutes a desirable retirement ‘lifestyle’ can prove difficult – and even more so when trying to figure out what actions they’ll then need to make today.

Much of this comes down to two basic factors:

- The influence and diversity of individual habits and behaviours, and

- The sheer number and complexity of variables that must be considered and calculated.

That’s where the power of free, easy to navigate online digital tools comes in. And there’s a number of them too, each serving a specific but important purpose, including but not limited to:

- Superannuation retirement savings calculators

- Super projection calculators

- Fund comparison tools

- Customised digital gadgets to

- Assist in determining retirement savings and

- Predict possible outcomes of various decisions.

The first step in planning for retirement

Over 60% of Australians rely on online superannuation calculators to plan for retirement. A figure that’s even higher among those aged 45+, who are closer to retirement age. These digital tools provide customers with a much-needed service: the ability to see how their current savings translate into a retirement lifestyle. For many, this is the first step in planning for their post-work years, and a key trigger to engage more comprehensively with their super fund.

For customers to find a helpful online tool, it must perform several vital tasks well. These include:

- Saving the customer time

- Helping them make better decisions

- Allowing them to compare different options

- Educating them on new or complex topics

- Helping them to feel more in control

- and even… entertaining them.

While some digital tools may do one or two of these well, very few manage to cover all bases successfully. Many funds fall short when it comes to their digital offerings – often because they’ve failed to understand how their customers want to engage with them and what they need for the experience to be valuable.

Get the fundamentals right to maximise return

Outside of brand-led community goodwill, the question remains: do these tools serve as an effective inbound sales mechanism, and what can brands stand to gain from customer usage?

It turns out quite a lot, but only if a genuinely customer-centric approach is taken in their creation, design, and execution. And this is why online calculators must be:

- Well-designed

- Customised

- Accurate

- User friendly

- Easy to update

- Able to make complex calculations across a wide range of variables and inputs

But are they good marketing investments?

With so many superannuation brands offering such services, it can be difficult for marketers to gauge the effectiveness of these tools. Yet unlike ad trackers and other software designed to capture user data and calculate ROI in real-time, online financial tools typically place user anonymity and privacy over intrusive lead generation tactics. But this doesn’t automatically dilute the marketing value of them. However, to ensure return on investment, data analysis to test and iterate for conversation and engagement should be undertaken.

Whether a fund places a calculator on its public-facing page or within its member-only portal, every dollar put towards customer acquisition and retention must work hard. That’s why it is so important for calculators to meet the diverse needs of users, and create a sense of engagement, connection and understanding.

Calculating success

When measuring customer engagement effectiveness from online tools, it’s always better to evaluate them in the context of the whole customer journey.

When viewed as part of a more effective system of customer touchpoints, the customer interaction with the calculator becomes less about lead capture and more of a meaningful brand introduction (This is a key reason why funds put calculators on their publicly accessible webpages, rather than their member-only pages.)

Marketers can then create digital experiences that are truly customer-centric and map the customer journey in a way that leads to increased customer acquisition, satisfaction, and loyalty.

The better your calculator design is, and the more relevant it is to your members’ lifestyles or needs, the greater the likelihood that your members will bond.

So, what makes an effective online calculator?

As Australia’s leading agency in creating online tools and interactive gadgets, here are four things to consider when creating an effective online engagement tool:

1. Keep it simple

When it comes to customer engagement, less is often more. As customers are bombarded with marketing messages from dozens of brands each day, they have become increasingly adept at filtering out anything that isn’t relevant to them.

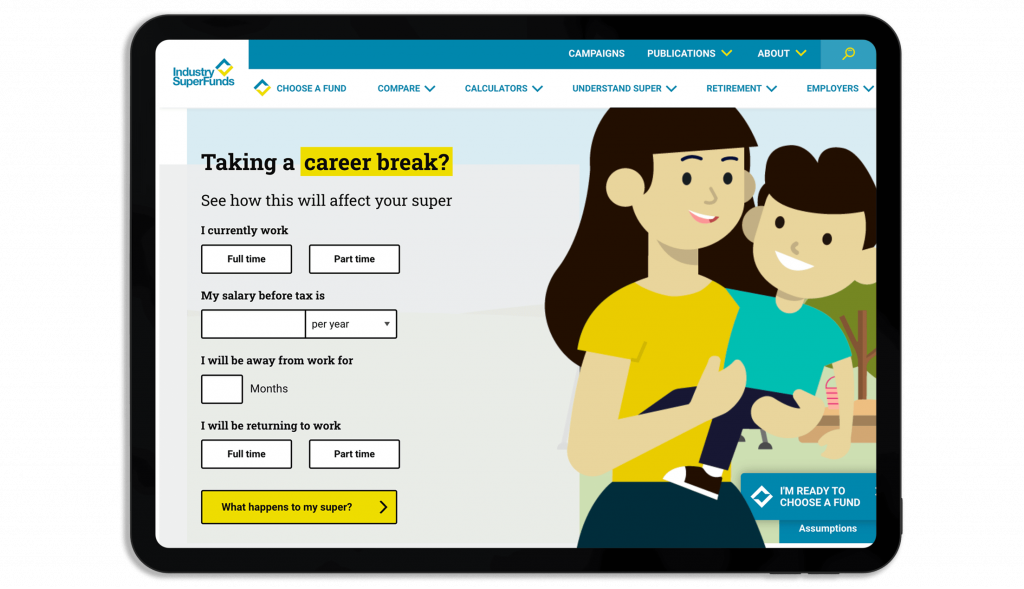

This means that you need to make sure your calculators are as intuitive and easy to use as possible. Customers should understand what the tool is for and how to use it within seconds. If not, they will quickly move on to something else.

2. Make it interactive

For customers to find an online calculator to be of any assistance, it needs to be more than just a static piece of information. It must be interactive and allow customers to input their own data and see results that are individual to their circumstances and aspirations.

The aim is to allow the user to test different scenarios to see how their future could look, the more engaged they will be, the more likely they will find it valuable, and encouraged to use it again.

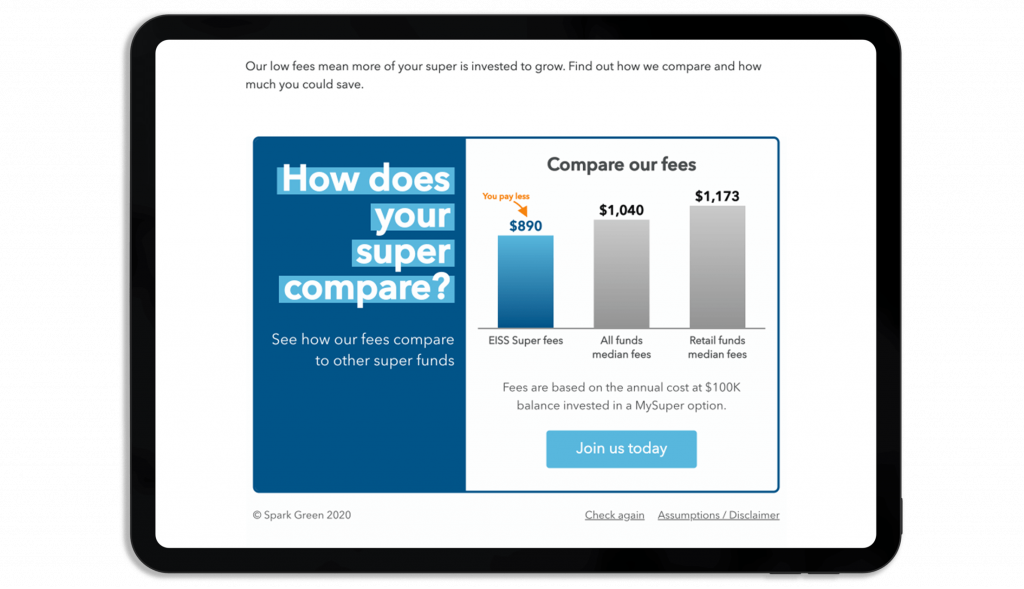

3. Use visuals

When it comes to customer engagement, visuals are key. Online calculators that use charts, graphs and other visualisations are more likely to capture customer attention, and hold it for longer than those that rely solely on text.

This is because humans are hardwired to respond to visual information. It can often be processed more quickly and efficiently than words and paragraphs. Using visuals can help customers understand the results more rapidly and make better-informed decisions.

4. Educate as well as inform

A superannuation calculator’s primary purpose is to provide users with the information they need to help them make better retirement planning decisions. But, the tool can also serve as a solid platform for education, awareness-building, and deeper engagement with the user’s super fund.

The calculated benefit for funds and their members

Online calculators are practical and powerful customer engagement tools, and when designed and delivered effectively, they can play a highly valuable role in helping brands achieve desired results in customer acquisition, retention and interaction.

To capitalise on their value and make the most of this potent customer engagement opportunity, it’s important that you genuinely understand how customers want to use these tools, and what they need from them for the experience to be valuable.

Calculators can also be used as a strategic component of wider customer engagement, for example, in conjunction with social media posts or in targeted marketing campaigns, workshops, EDMs, and on landing pages. The greater the level of inter-activity, the greater traction and ROI the tools will have.

Ultimately, a relevant, well-designed, and intuitive interactive tool can genuinely help your brand win new customers and retain existing ones. To see what we mean, take a look at recent calculators and other online tools that we have created to help businesses stand out from the competition.

Need help to engage and empower your members?

Have a chat to us about how you can utilise online engagement tools for your business.