First Home Super Saver Scheme – risk or opportunity?

Proposed changes to the superannuation system always cause concern and uncertainty, particularly for super funds, when those changes allow members early access to finances intended to fund retirement.

The Federal Government’s 2017 introduction of the First Home Super Saver Scheme (FHSS) to tackle the nation’s crisis in home ownership affordability certainly received a frosty welcome. Some saw it as a threat, while others feared it would increase already heightened property prices. Industry concerns were further reinforced by the early release of super to combat the financial pressures from the pandemic alongside additional changes to the FHSS Scheme in 2021.

It’s a hot topic

Despite a lack of awareness and understanding, there is still substantial interest in the scheme. Our research on Google searches indicates that approximately 150,000 people have searched for FHSS (and associated terms). Furthermore, this has increased by 200% to around 450,000 searches since 2021. All without active promotion of the scheme by super funds or the Government. More importantly, these searches are coming from cohorts younger than those who typically search for super. This is a topic that’s not only aligned with super funds’ interests but also important to disengaged members, so initiating the conversation will give them the sense of connection they’ve been missing. The level of interest presents an opportunity for funds to provide support and insights into related First Home Owners Grant schemes that younger members are also searching for and can use in conjunction with the FHSS scheme.

Win the hearts of the young cohort

While most super funds have provided some information on the FHSS Scheme through their website or an article, the scheme has received minimal promotion since its launch. It’s, therefore, no surprise that member take-up of the scheme has been low. Through discussions with super funds and aligned industries, we’ve discovered that member understanding of the scheme can also be improved.

Putting aside that early access to super goes against the purpose of the superannuation system, we believe there is a positive side to the FHSS Scheme. It presents a unique opportunity to engage with and support younger members, connect them with their super and help them overcome challenges in homeownership.

Let’s talk FHSS Scheme

Details of the FHSS Scheme

In a nutshell, the scheme allows first-home buyers to make voluntary contributions of up to $15,000 p.a. to their super. By applying through the ATO, they can withdraw a total of $50,000 to help them place a deposit on their first home. Given that typically a couple would be saving for a deposit, the scheme allows (if they are both first-home buyers) each person to withdraw up to $50,000 for a total deposit of $100,000.

The low down

- Who? Accessible to first-home buyers

- How? Through saving via super

- What? Super voluntary contributions

Who?

Typically, first homebuyers tend to be from the younger cohort – often the very ones who are least engaged in their super. Suddenly, the FHSS Scheme brings super front of mind for those whom retirement is so far away even to contemplate.

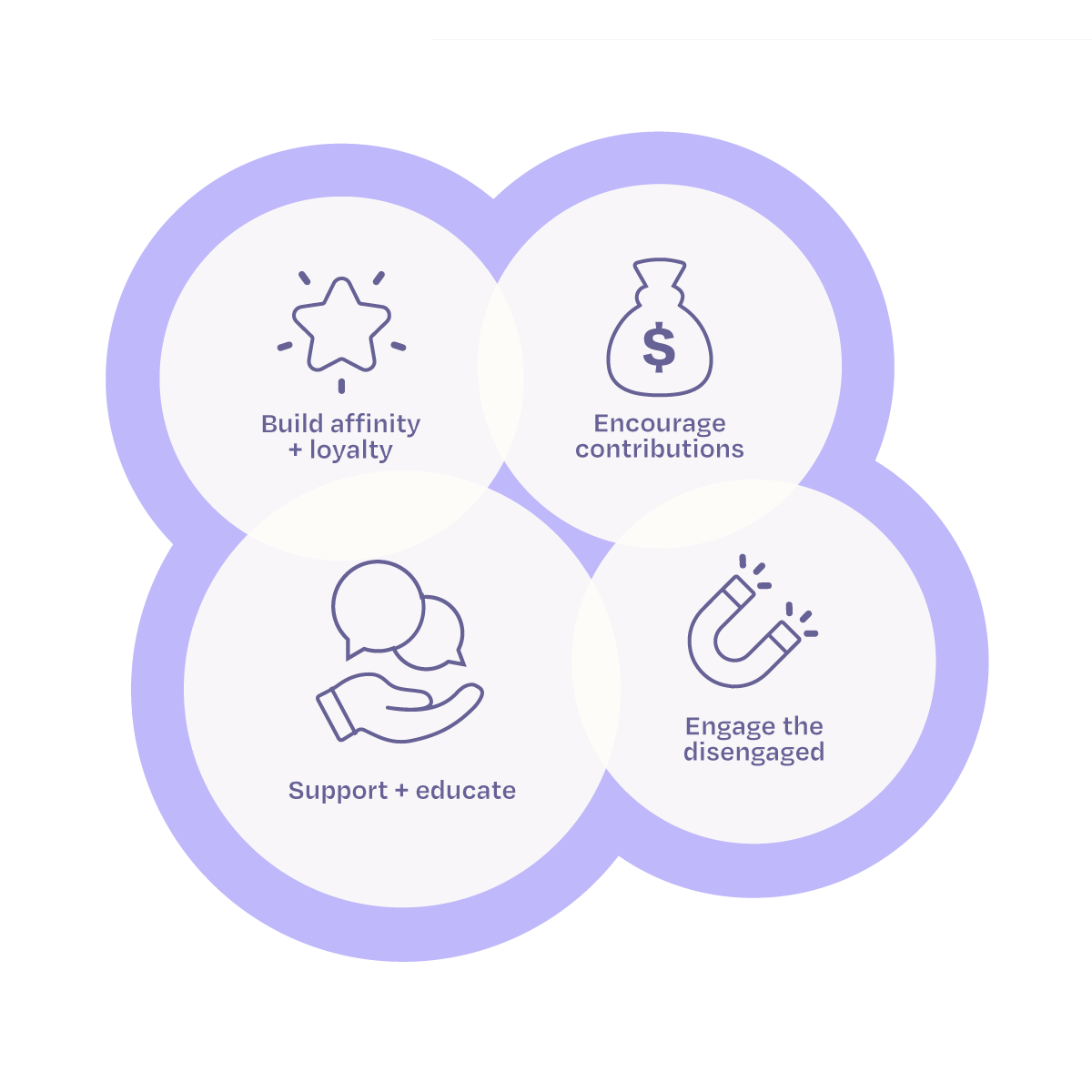

The FHSS Scheme has opened the ideal opportunity for super funds to connect with these members, build rapport, and foster long-term relationships. This is especially powerful when funds offer support, advice and guidance surrounding the scheme. It can lead to members viewing their fund as a valuable partner in their dreams of homeownership and their future lifestyle. Early engagement and seizing the chance to simultaneously provide information, insight and education, can be a very powerful tool in creating long-term affinity and brand loyalty.

How?

For many people, making voluntary contributions is quite unattainable, made even more so due to recent cost-of-living challenges. The FHSS Scheme can help change that thinking –by highlighting it and encouraging it. In effect, the FHSS Scheme becomes a focused saving alternative to a regular bank account, benefiting from the tax concessions that accompany super contributions and earnings.

What?

Members, particularly younger ones, often see voluntary contributions to super as unappealing, unnecessary, and incompatible with their lifestyle. However, the FHSS Scheme, is an opportunity to change that mindset and help develop positive contribution habits. The scheme provides a tangible short-term reason for members to make voluntary contributions. Once members get into the routine of salary sacrificing or making regular contributions, the uncertainty or presumed ‘pain’ of diverting income to super can be alleviated, given the benefits of using the scheme. Members not only become familiar and comfortable with the concept of voluntary contributions, but they understand the advantage that even small contributions can make over time.

Effective digital approach

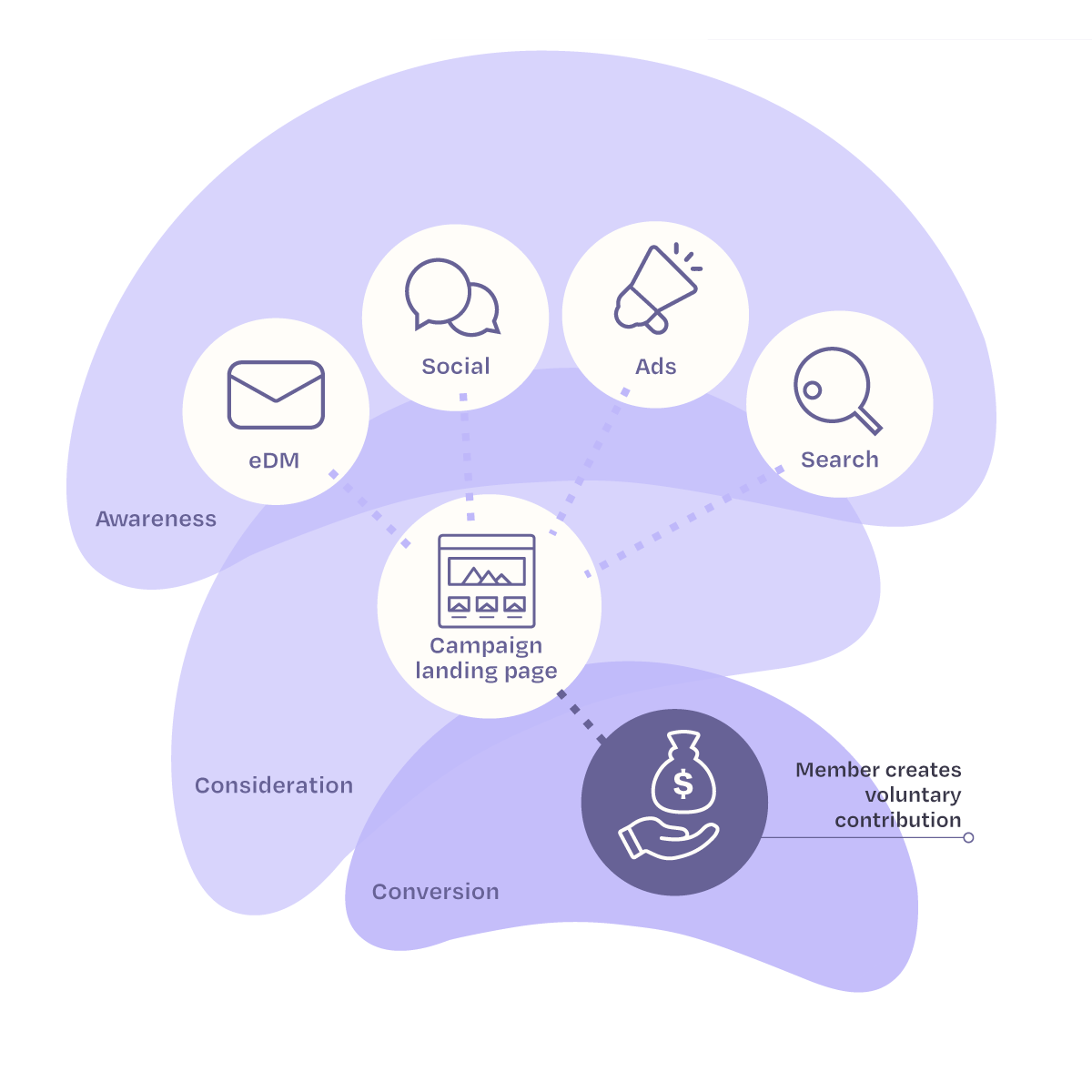

While articles are informative for some members, a more effective and engaging approach is a multi-pronged campaign, including engagement tools, eDMs, SEM and digital strategy. This ensures a focus on the holistic member journey that builds loyalty and drives conversion.

A well-designed and most importantly, easy-to-understand engagement tool is paramount in this strategy. Why? Because it demonstrates how using the FHSS Scheme can substantially accelerate home deposit savings through super compared to a savings account. Depending on salary and tax bracket, deposits can be accelerated by 30% or more*. An engagement tool demonstrates how boosting super now can prove beneficial both at the time of withdrawal for a home deposit and the future in retirement. Providing this useful, personalised information interactively, presents the fund in a positive, helpful and specialist light. Younger cohorts respond to information broken down into simple, bite-sized pieces, including info graphics, video and concise copywriting.

Australians are currently searching for FHSS tools and calculators. Now’s the time for you to grow the connection with your members by helping them understand the scheme and its benefits.

Want to know more?

Get in touch and we’ll give you the lowdown.

*Source: https://treasury.gov.au/sites/default/files/2022-03/first-home-super-saver-scheme.pdf