Are your retirement calculators performing?

Retirement calculators aren’t just compliance and advice tools – they’re one of the most powerful ways to connect with members who are starting to think seriously about retirement.

Over the past year, we’ve rebuilt and relaunched our suite of financial engagement tools for some of Australia’s leading super funds, and seen first hand how interactive calculators can drive engagement, drive advice conversations, and even improve retention.

The truth is, most members approaching retirement don’t start with advice – they start with curiosity.

For super funds looking to connect with members who are starting to think about retirement, engaging interactive tools and calculators offer a highly effective solution. Simple, easy to use interactive tools are often the first step in exploring their options and building confidence.

When promoted effectively across a fund’s website and member portal, these tools become the bridge to deeper content, guidance & advice, and ultimately, member retention.

They can also play a pivotal role in SEO and AI-driven discovery, ensuring your fund shows up when members start searching for answers.

SGY calculators by the numbers

Our calculators are heavily used, with very strong average completion rates. Across our suite of production calculators, the primary users are in the approaching-retirement phase – typically aged 45–64.

This is a critical demographic: they have higher balances, higher incomes, and are beginning to actively plan their retirement outcomes.

Translating this initial engagement into key CTAs such as advice, personalised education, exploring products and extra contributions can form a critical part of a member retention strategy.

Why SGY calculators?

- Personalised & engaging – members see their own outcomes instantly

- Fully embeddable with custom branding – embedded inline on fund websites with their own branding

- Easy to use – mobile-friendly, accessible, customisable

- Conversion-focused – high completion & CTA click-through-rates (~87% avg. completion rate)

- SEO-ready – rank for high-volume “retirement/super calculator” search terms

- Compliant, secure and flexible – actuarial sign-off and RG267 aligned, fully customisable

- Built for deeper engagement – contextual CTAs seamlessly link to advice, learning, or extra contribution journeys

As our partners expect deeper customisation and more secure integration, we’ve rebuilt all our calculators around secure APIs and dedicated front-end libraries. This means calculators can now be fully embedded across public sites and member online (MOL) environments, with customisable branding, copy, assumptions, and dynamic CTAs.

Measuring ROI: Beyond clicks and compliance

When implemented strategically, these tools deliver real value across multiple dimensions:

- Member engagement and retention: reach and engage high-value pre-retirement cohorts (45–64), increasing likelihood of retaining them up to and beyond retirement.

- RIC alignment: support member retirement readiness with measurable engagement.

- Conversion funnels: turn curiosity into action – advice bookings, extra contributions, and product exploration. And early engagement with fund advice supports retention.

Funds that actively promote calculators across their website and member online (MOL) platforms see not just traffic – but deeper engagement and repeat sessions that correlate strongly with better advice and contribution outcomes.>

Our core calculator range

Here’s our core range of API-supported engagement tools, with links to live examples on client sites.

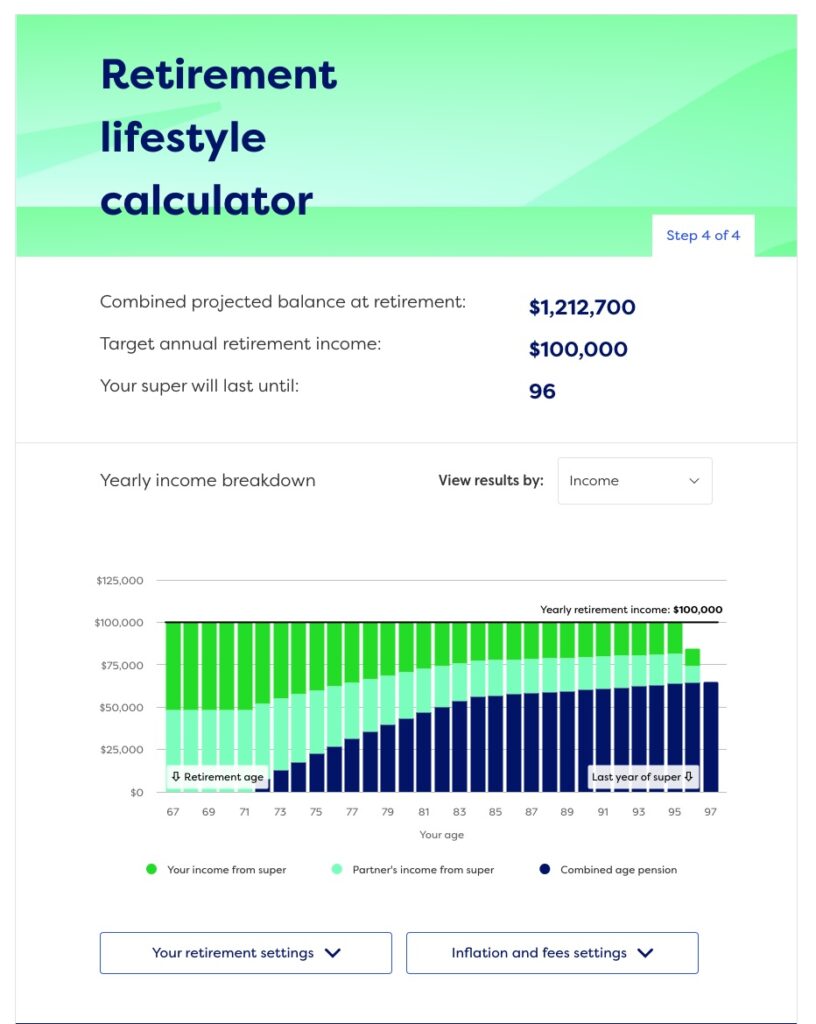

Retirement Income & Balance Projections

This tool projects retirement balances and income sources (including age pension). It demonstrates how variables such as target retirement income, retirement age, fees and additional contributions can make a difference to retirement balances. It supports both singles and couples.

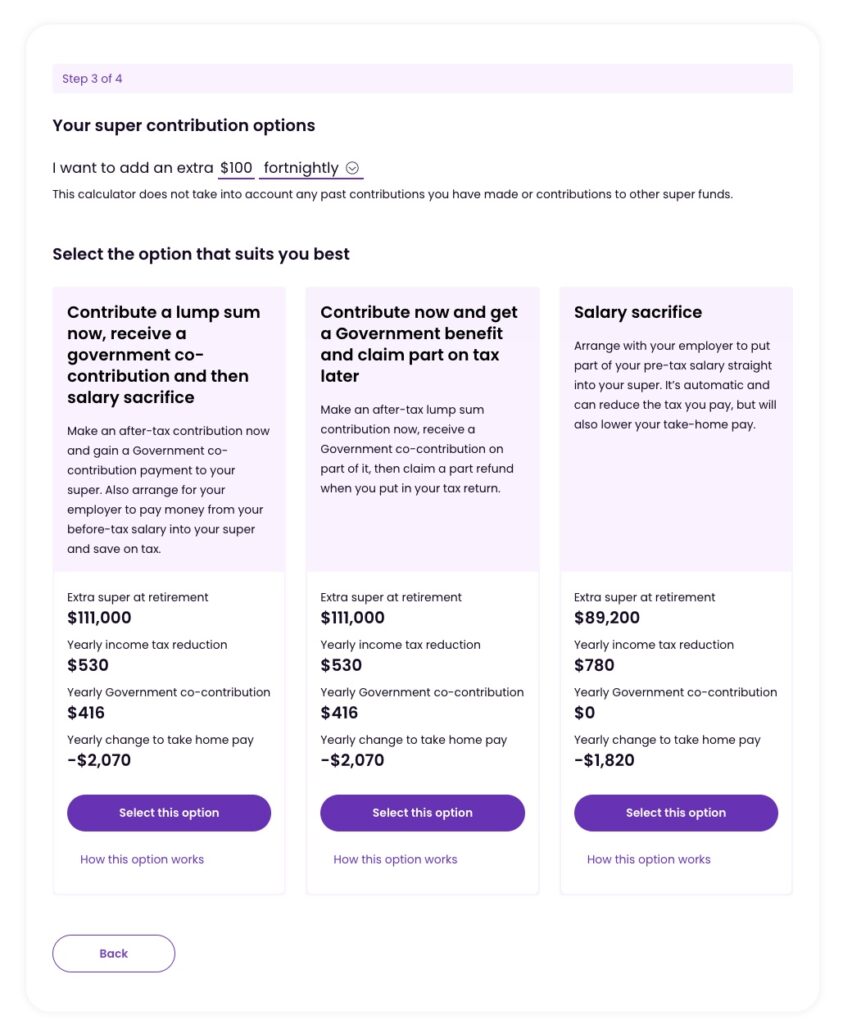

Contributions Optimiser

“What’s the best way and impact of more super contributions?”

Shows salary sacrifice / after-tax contribution strategies, with CTAs to advice and extra contributions.

Prime Super’s Contribution calculator: click image to see live version

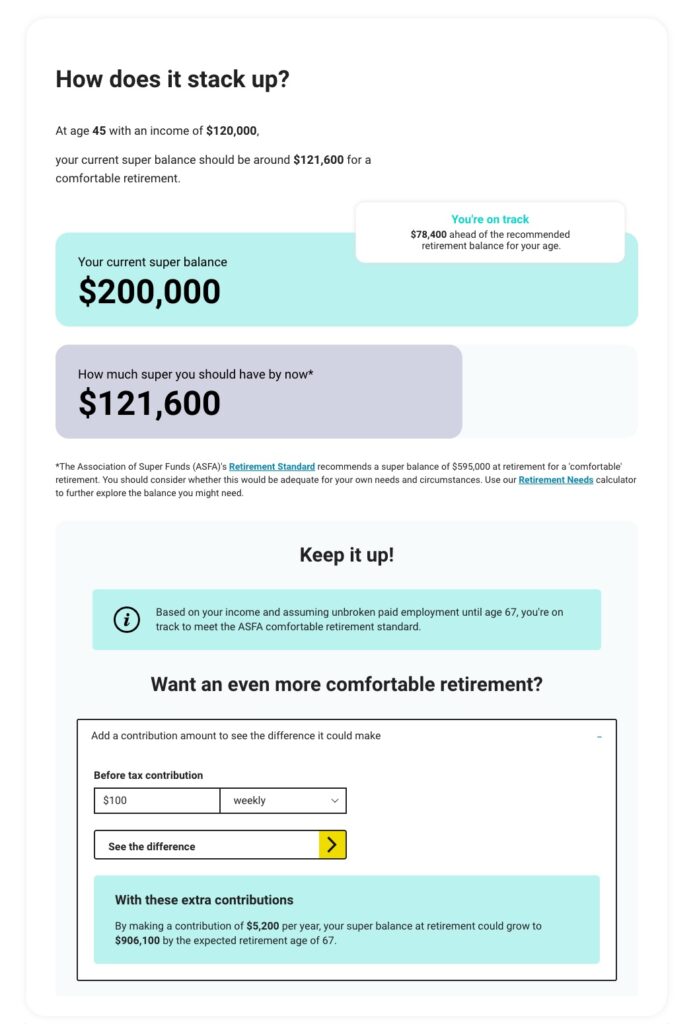

Balance Comparison (“How Much Super Should I Have Today?”)

Our Balance Comparisons tool compares the users’ current balance by age against ASFA recommended target balances based on age and current income. This calculator can also display ATO average balances as an additional step, as well as model the impact of extra contributions to make up any balance shortfalls.

Industry SuperFund’s ‘How much super should I have’ calculator: click image to see live version

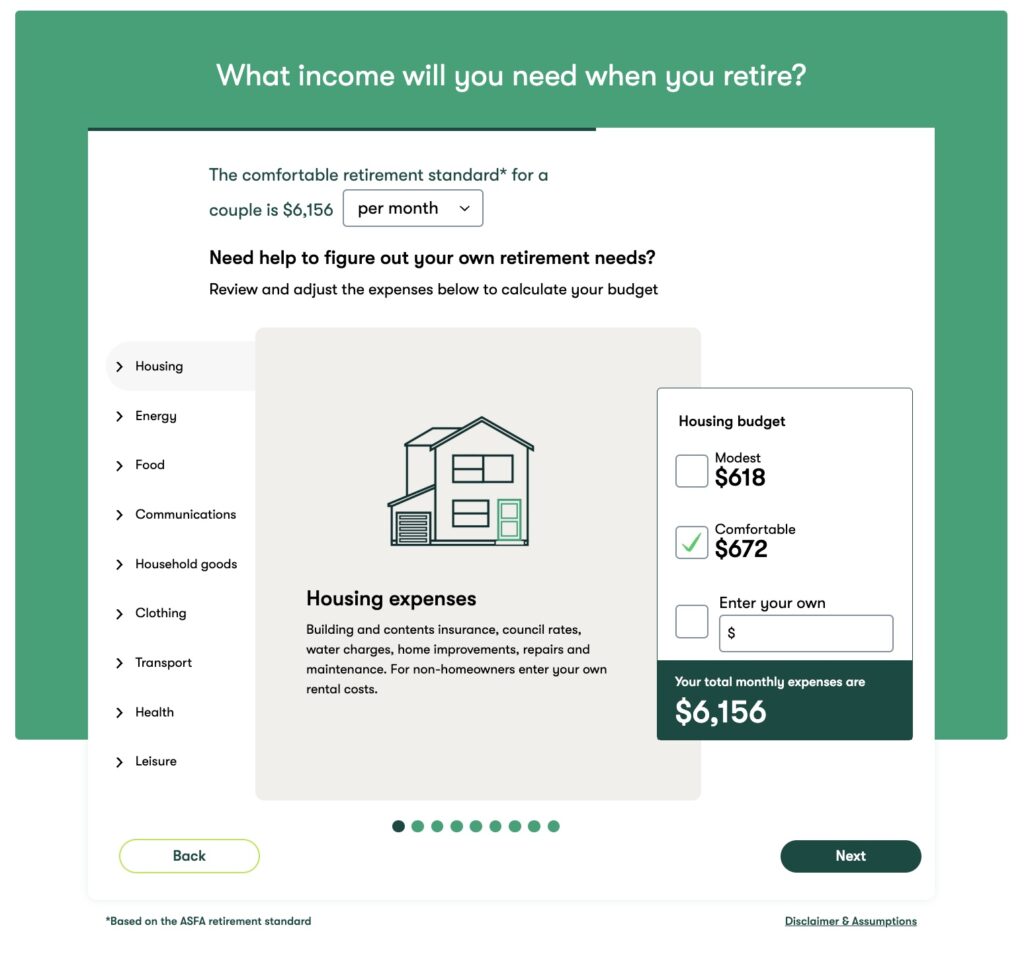

Retirement Needs

The Retirement Needs calculator helps users understand how retirement balances and income relate to ongoing and one-time retirement expenses across a range of ASFA standard household expenditure categories.

Retirement Drawdown / Decumulation

Models post-retirement income streams, drawdown scenarios, and pension eligibility and income.

Equip Super’s retirement drawdown calculator: click image to see live version

Transition to Retirement (TTR)

Projects the benefits of different Transition to Retirement (TTR) strategies for users close to retirement age, linking to related product information and advice conversations.

Equip Super’s transition to retirement calculator: Click image to see live version

Want to learn more about how our tools can drive performance?

we’d love to talk to you about how our tools could fit into your fund’s digital strategy.